By Michael Goosay, chief investment officer fixed income, Principal Asset Management

What lies ahead for fixed income investors in the year ahead?

In short, heightened uncertainty breeds opportunity—and fixed income markets should be brimming with opportunity in 2025. With so much prospective noise on the horizon, fixed income investors need to identify the signal and relative value that will deliver over the long term, and focus on two major factors when assessing what will drive fixed income performance in the year ahead:

- Starting yield levels

- Credit spread dynamics

Starting yield (income) levels

Assuming President Trump follows through on his “promises made, promises kept” mantra, there will likely be early upward pressure on inflation through the swift enaction of tariffs and pursuit of tax cuts. This, in turn, would complicate the FOMC’s quest for price stability and the path for lower policy rates. Given the FOMC’s steadfast commitment to data dependency, any notable resurgence in inflation—alongside an unwavering U.S. economy—will likely lead to a pause or more tepid pace of policy adjustments.

In the end, heightened inflation expectations should lend itself to continuing elevated yield environment in early 2025. However, we still believe the longer-term path of rates is more likely lower versus higher and anticipate duration (or interest rate sensitivity) will be a tailwind for fixed income investments over the course of 2025.

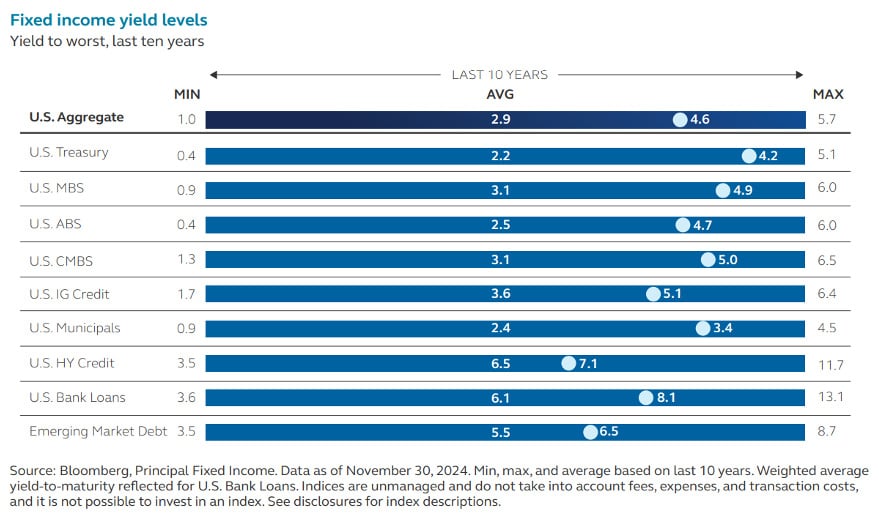

Fixed income investors should consider the early 2025 rate environment a unique entry point to capture attractive starting yield levels, extend duration and mitigate reinvestment risk.

With a greater likelihood for the lasting path of front-end rates to be lower versus higher, increasing duration now will better position a portfolio to take advantage of falling rates. Coincidentally, increasing duration will reduce the risk that an investor sitting in cash and cash equivalents today will have to reinvest that money at a lower rate by locking in yield for a longer period. As the year progresses, high-quality, longer-duration fixed income should outperform on a risk-adjusted basis as the inverted yield curve steepens and an economic slowdown becomes more apparent. Fixed income instruments with more duration should benefit as yields on the front end of the curve fall below the yields on the long end of the curve. Holding investment grade paper should better position portfolios to weather an economic downturn and help reduce default risk.

Credit spread dynamics

Credit spreads will likely remain rangebound, with a modest widening bias, over the course of 2025. With tight spreads, our appetite for outright “risk on” positioning entering the new year is muted, and yields and carry should remain attractive. The decisive outcome of the U.S. election acted as a risk clearing event and a positive development for credit markets by alleviating concerns over a prolonged and contested decision. We held a positive outlook for investment-grade and high-yield credit leading into the election. Following the results, conviction was maintained in select investment-grade and high yield credit opportunities. This thesis is underpinned by stable corporate fundamentals and attractive yields, which bolster an already strong technical backdrop. If rates remain somewhat elevated, yield buyers should continue to view corporate bonds as an attractive asset class. The immediate post-election rally in risk assets—of which credit markets are a part —reflects the projected pro-growth agenda and higher-for-longer rates thesis. Moderating supply into year-end also makes the supply/demand equilibrium picture look good heading into 2025.

Also read: Why Bond Investors Should Not Despair

The financial and energy sector should benefit from anticipated deregulation and pro-growth policies under a Republican-led government. Overall, tariffs (higher), taxes (lower), and corporate regulation (looser) policies are the key market drivers following the election. On the flip side, the utility sector could face negative headwinds under a Trump administration, as lower taxes might negatively affect regulated utilities. Moreover, the pharmaceutical, building materials and retail sectors are most exposed to a potential tariff spike.

Looking ahead

All told, investors should be excited about the opportunities that await fixed income markets in the year ahead. While the heightened uncertainty and episodic volatility may endure, this will likely create ample opportunities for fixed income investors. With a prospective environment of gently slowing economic growth and monetary easing, exposure to fixed income remains prudent for investors. Fixed income assets provide a reliable source of income and yield, offer mitigation against widespread market volatility, and present opportunities to enhance returns within investment portfolios.