By Catherine Braganza, Senior Portfolio Manager, Insight Investment

This excerpt is derived from Insight Investment’s ‘Thoughts for 2025’ Paper. To view the full report, click here.

As the global economy navigates ongoing uncertainties, investing in high yield credit presents a unique opportunity for investors to harness the power of compound returns. With its potential for exponential growth, high yield credit stands out as a particularly attractive asset class. By strategically managing risks and focusing on minimising defaults, investors can not only enhance their returns but position their portfolios for long-term resilience and success.

Harnessing the power of compound returns

One of the most powerful tools for investors is the concept of compound returns.

This is where returns earned on investments increase the capital of the investor, resulting in the exponential growth of their investments over time. The higher the returns that can be generated, the greater the power of compounding.

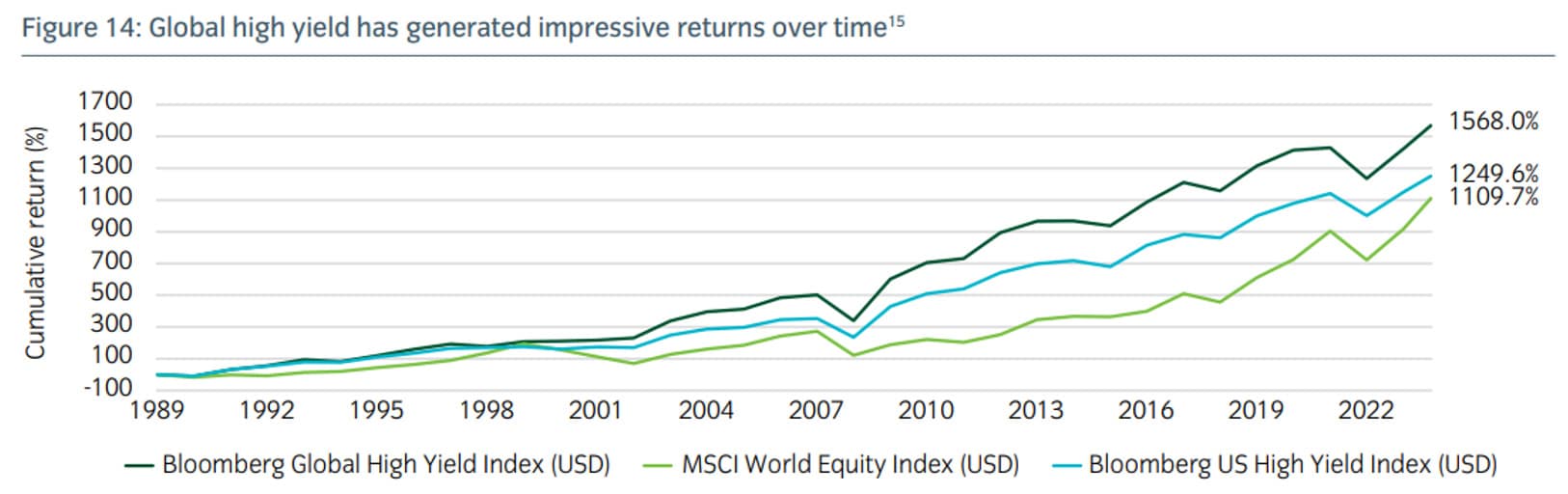

We believe high yield credit is an asset class that is particularly suited to compounding returns over time. With market yields sufficiently high to amplify the power of compounding, the potential for long term growth is especially compelling. As we can see in Figure 14, over the long term, investors in global high yield have even outperformed global equity markets.

Minimising defaults maximises returns

When investing in high yield credit, defaults are an important factor for investors to consider. Although the impressive long-term returns in Figure 14 include the impact of defaults, the potential returns could be even greater if defaults can be avoided.

Also read: Bond Time

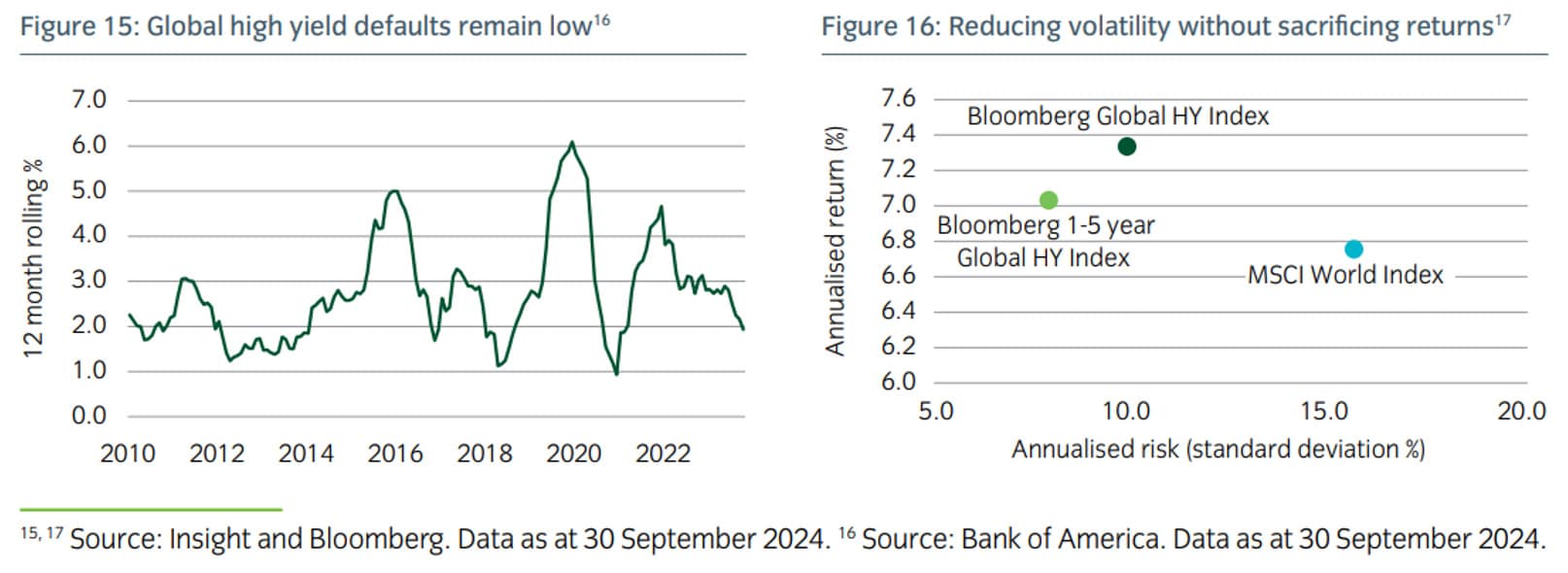

Encouragingly, high yield corporates have weathered the sharp increase in interest rates over recent years and defaults in the current cycle are at relatively low levels (see Figure 15). There has been a structural change within high yield markets which should help make high yield more resilient to defaults than it has been in the past. Between 2007 and 2023, the proportion of US high yield issuers rated BB, the best rating category for high yield, increased from 37% to 47%, while the proportion rated CCC declined from 21% to just 13%. In European high yield, just 5% of the market is now rated CCC.

Private credit investors have increasingly provided bespoke financing solutions to more stressed companies, which also improves the overall credit health of the high yield market.

In our experience, focusing on shorter-dated strategies, where cashflows and business models are more visible, further reduces default risks. The Bloomberg 1-5 year Global HY Index has a very similar return profile to the broader Bloomberg Global HY index but with lower volatility, providing better risk adjusted returns (see Figure 16). Additionally, prioritising larger corporate issuers that have been downgraded from investment grade provides another effective strategy to minimise risks.

Balancing Risk and Reward in High Yield Credit

Adopting thoughtful strategies within high yield credit not only balances risk and reward but also capitalises on the power of compound returns to drive exponential growth over time. By focusing on minimising default risks, leveraging shorter-dated strategies, and prioritising quality issuers, investors can build resilient portfolios well-positioned for sustainable, long-term success, even in uncertain economic environments.