The first half of 2021 has seen strong growth in green bond funds including social and sustainability bonds, with Bloomberg reporting about US$294 billion raised in the sale of green bonds.

Green bonds are designed to support climate or environment-related projects and bond investors are joining their equity counterparts to influence change.

Whilst there is much talk about how transparent and effective some of these green bond funds are, the importance of a broad range of measures to consider the real impact of environmental, social and governance (ESG) investments will keep the sector moving forward.

What’s clear is that green investments are paving the way in achieving both positive financial returns and a positive environmental impact.

3 Green Bond Funds You Should Consider

1. PIMCO ESG Global Bond Fund

From fixed income investment manager PIMCO, the PIMCO ESG Global Bond Fund is a diverse, actively managed portfolio of global fixed-income securities designed for investors who wish to have a broadly diversified exposure to global fixed interest markets while considering ESG factors, like many other green bond funds.

Set up as a true core bond holding with a core allocation to global fixed interest, the fund aims to provide a diversified exposure to multiple economies, yield curves and sectors, which can improve risk-adjusted returns. It offers the potential for investors to achieve returns consistent with other core bond strategies while also making a positive social impact. The fund seeks to influence positive change whilst delivering strong, long-term performance.

PIMCO says their approach to sustainable investing integrates dedicated ESG research with a robust credit research process to identify relative value opportunities while optimising the portfolio using ESG-based criteria. They also seek to actively engage with issuers with the goal of improving their ESG-related business practices.

As of 20/6/2021 the fund had total net assets of AUD$151.5 million with distributions paid quarterly.

In summary, this fund aims to deliver a core bond experience with an ESG presence.

Performance |

1 Mo |

3 Mo |

FYTD |

1 Yr |

3 Yr |

SI |

| Net of Fees (%) | 0.21 | 0.82 | 2.27 | 2.27 | 4.14 | 3.81 |

| Benchmark (%) | 0.49 | 0.94 | -0.17 | -0.17 | 4.03 | 3.75 |

| Outperformance (%) | -0.28 | -0.12 | 2.44 | 2.44 | 0.11 | 0.06 |

Returns for periods longer than 1 year are annualised

Net of Fees – Fund performance is quoted net of fees and expenses and assumes the reinvestment of all distributions but does not take into account personal income tax

SI is the performance since inception. Inception date is 09/03/2017

The benchmark is the Bloomberg Barclays Global Aggregate Index (AUD Hedged)

2. Dimensional Global Bond Sustainability Trust AUD Class

From global investment firm Dimensional, the trust is managed to invest in a broadly diversified portfolio of eligible intermediate term domestic and global fixed interest and money market securities. The portfolio’s investment decisions are adjusted to take into account certain environmental and sustainability impact and social considerations.

The trust is not managed with the objective of achieving a particular return relative to a benchmark index, however, to compare the performance of the trust with a broad measure of market performance, reference may be made to the Bloomberg Barclays Global Aggregate Bond Index hedged to the Australian dollar. As at 30 June 2021 the fund had net assets of AUD$573.4 million.

Annualised returns as at 31/7/21

Fund |

Reference Index |

|

| YTD | -0.47% | -0.38% |

| 1 Year | 1.01% | 0.05% |

| 3 Year | 5.48% | 4.46% |

| Since inception | 5.03% | 4.14% |

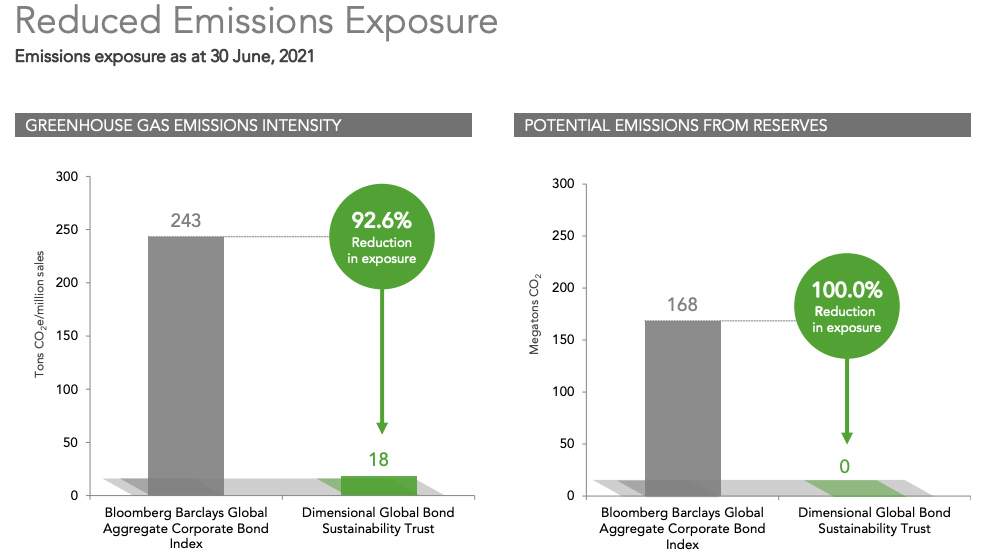

Dimensional provides a sustainability report for the trust comparing exposure reductions compared to the Bloomberg Barclays Global Aggregate Corporate Bond Index.

In terms of greenhouse gas emissions, the fund had 92.6% less emissions than the composition of the Bloomberg Index.

3. BetaShares Sustainability Leaders Diversified Bond ETF Currency Hedged (GBND)

This bond ETF from ETF manager BetaShares aims to track the performance of the Solactive Australian and Global Select Sustainability Leaders Bond TR Index – AUD Hedged that comprises a portfolio of global and Australian bonds screened to exclude issuers with material exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations.

BetaShares says that at least 50% of GBND’s portfolio is made up of “green bonds”, issued specifically to finance environmentally friendly projects, as certified by the Climate Bonds Initiative. That is, bonds specifically issued to finance independently certified environmentally friendly projects.

BetaShares says that the fund’s exposure is to a diversified portfolio of both global and Australian bonds issued by a wide range of government and corporate issuers.

Fund Returns After Fees (%)

Fund |

Index |

|

| 1 month | 0.37% | 0.41% |

| 3 months | 0.38% | 0.50% |

| 6 months | -2.57% | -2.35% |

| 1 year | -0.55% | -0.04% |

| 3 year p.a. | – | 4.48% |

| 5 year p.a. | – | 3.58% |

| Since inception (p.a.) | 1.09% | 1.52% |

| Inception date | 26/Nov/19 |

*As at 30 June 2021

Whilst each of these three green bond funds are different in the nature of their investments and transparency, they are all directing their fund flows based on various ESG criteria. Analysts believe the number of green bonds is going to keep climbing and within a few years will amount to trillions in value globally, with a marked positive climate action ensuing across the world.

For more information, see FINA’s Managed Fund Finder or the ETF Finder.

This article does not constitute investment advice and is general in nature. The information does not take into account your objectives, financial situation or needs. It is not specific to you, your needs, goals or objectives. Because of that, you should consider if it is appropriate to you and your needs, before acting on the information. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product. Please read our terms and conditions for further information.